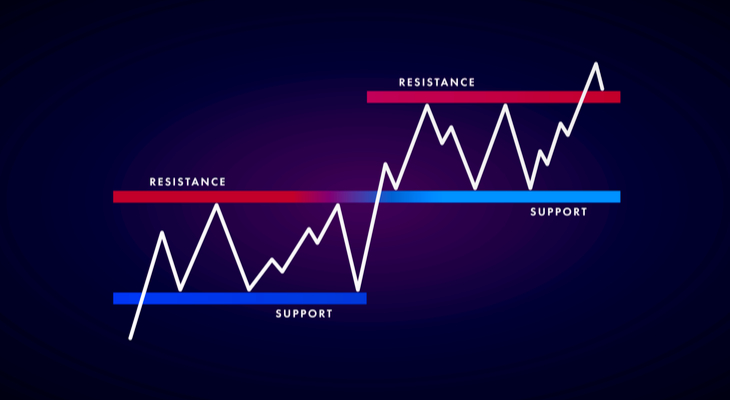

Levels of support and resistance are a crucial component of Forex trading that require careful comprehension. It is extensively used and represents choices made in the real world at various levels.

This is the most basic type of assistance and opposition. Resistance occurs when the market rises and is pushed back at a particular level. A level is regarded as a support level if the market is falling and the price increases noticeably.

Even if these levels exist in the market, you will frequently see them violated or put to the test. The price shatters through these levels when they are broken. In contrast, when they are being tested, price will begin to inch up towards the levels, and you may use candlestick analysis to spot potential turning points.

Depending on the time frame, different levels of support and resistance hold varying strength.

This means that a daily support or resistance level will be far more powerful than a level for a single minute. This is because volatility has less of an effect over longer time scales, which are also where institutional buyers and sellers from both the private and public sectors put their orders.

You can select various levels of support and resistance while trading forex:

- 4 Hourly

- Daily

- Weekly

- Monthly

If you search for anything below these time frames, support and resistance levels can become easily broken and the theory itself can lose value. These levels in these time frames will have a huge impact on charts.

Draw down what you believe to be excellent and bad levels of support and resistance for support and resistance to observe how well different levels operate. Practise drawing these levels using back testing. Go back 10 years worth of candlesticks.

.png?v=1)